Wednesday, December 20, 2006

The Prices Are Falling Like Snow In Canadian Real Estate

In Canada's major real estate markets the average price for a resale home fell $3,500 in the month of November. In Vancouver the price fell a whopping $29,000, but the average price there is still about $520 K. In red hot markets such as Calgary the prices dropped as well. Don't get too upset, prices are still way up over the same month last year, 36% in Calgary and 42% in Edmonton. The full article is available at CBC.ca.

Wednesday, December 13, 2006

Bill 152 - Real Estate Fraud

The Ontario government has passed a bill that increases the penalties for mortgage and real estate fraud, yet they deny the increasing problem. The new law enables mortgages and titles obtained under fraudulent means to be null and void. This is a step in the right direction, but mortgage fraud is a growing problem, with the current maximum fine being only $1000.

A conference in Toronto has pointed out Canada as "a world leader in mortgage fraud." This is not a positive thing. The conference of law enforcement officials says more has to be down about real estate fraud, as the reward is much higher than the risk involved in the crime.

Tackling Homelessness

Vancouver has a growing problem, the homeless. As real estate prices rise every corner of the lower mainland is being developed. Single Room Occupancy (SRO) Hotels are being converted, or replaced by new Condos that sell for hundreds of thousands. The displacement of people is something Vancouver must deal with before it gets out of hand, and they are taking note from places like San Francisco and New York.

A conference in Toronto has pointed out Canada as "a world leader in mortgage fraud." This is not a positive thing. The conference of law enforcement officials says more has to be down about real estate fraud, as the reward is much higher than the risk involved in the crime.

Tackling Homelessness

Vancouver has a growing problem, the homeless. As real estate prices rise every corner of the lower mainland is being developed. Single Room Occupancy (SRO) Hotels are being converted, or replaced by new Condos that sell for hundreds of thousands. The displacement of people is something Vancouver must deal with before it gets out of hand, and they are taking note from places like San Francisco and New York.

Friday, December 08, 2006

Real Estate Prices In Vancouver Are Ridiculous

Yes, Real Estate prices in Vancouver are ridiculous. But there may be hope for a decrease in home prices. Analysts have seen huge price increases in Vancouver in the past, and they have always been followed by a trough. The cycle has been evident for the last 30 years, so perhaps we can expect a price relief on Vancouver home prices. Read the article in the Sun and make conclusions for yourself.

On a completely different, but just as interesting topic Google has ventured into radio advertising. Google is beta testing radio ads that customers can sign up for through their adwords account. The company has selected a few choice customers to try the new approach.

On a completely different, but just as interesting topic Google has ventured into radio advertising. Google is beta testing radio ads that customers can sign up for through their adwords account. The company has selected a few choice customers to try the new approach.

Thursday, November 30, 2006

Discount MLS Brokers Are On The Ropes

Realtysellers Ltd of Toronto has declared that it can no longer operate in the current real estate sales climate produced by the CREA. Discount brokerages, such as Realtysellers have been accused of dumping homes into the MLS network. The CREA has no restricted access to the MLS network by stating that all homes must be inspected by the listings realtor before being shown on MLS. Realtysellers is fighting the new rules, and many other discount brokerages across Canada may be in for a fight to maintain there market.

Discount firms will sell a home, with full MLS coverage, for as little as $495. CREA is against this low budget approach because most of the over 80,000 members of the CREA work on commission. You know, 1.5% to 6% of the sale. On a $100,000 sale this CREA members are making off like thieves. Bottom line is that CREA is trying to maintain the monopoly it have over the real estate industry. Can't blame them really. Would you take a pay cut?

Check out the article in the Globe and Mail

Discount firms will sell a home, with full MLS coverage, for as little as $495. CREA is against this low budget approach because most of the over 80,000 members of the CREA work on commission. You know, 1.5% to 6% of the sale. On a $100,000 sale this CREA members are making off like thieves. Bottom line is that CREA is trying to maintain the monopoly it have over the real estate industry. Can't blame them really. Would you take a pay cut?

Check out the article in the Globe and Mail

Tuesday, November 28, 2006

Fraud and Investment - The Two Can Usually Be Found Close Together

Where the money flows there is always someone trying to skim a little off the top, or trying to skim a lot. With the past boom in real estate in Canada, fraud has become a big concern for people in the real estate industry. The Ontario Law Society has is in the midst of a crack down on fraud. Lawyers are an integral part of real estate transfers, and have been accused of ripping people off. The Star has the complete story on what is being done about the problem.

Canadian investment companies are going abroad in their search for real estate investment. To date this year companies and investment funds have invested nearly 10 Billion dollars in foreign real estate. One major deal involves a Quebec company buying a shopping centre in Germany.

Canadian investment companies are going abroad in their search for real estate investment. To date this year companies and investment funds have invested nearly 10 Billion dollars in foreign real estate. One major deal involves a Quebec company buying a shopping centre in Germany.

Tuesday, November 21, 2006

Edmonton Real Estate Is Still In A Tough Spot

Edmonton, Alberta has seen a rise in the conversion of apartment buildings into condominiums. The rise in real estate prices in the city, about 40 percent in the last year alone, has buildings switching to collective ownership. Of course this is not great news for everybody. The renters that cannot afford to buy into the new condo building are being forced out of their homes. Edmonton already has a rental shortage and condo conversions add to the problem. CBC.ca Has the full story and the problems involved.

Quebec and Discount Brokerages

Discount brokerage Proprio Direct was fined in 2001 for practices not inline with the province's real estate code of ethics. Proprio Direct charged a flat fee up front in order to sell a client's property. This type of fee is not inline with the real estate association standard of a percent of the selling price of a property, after the sale is complete. The Montreal based firm has fought the fines every step of the way, and now the decision is going to the Supreme Court. Use a real estate website and save thousands is what I would say. The full article can be found at Canada.com.

Quebec and Discount Brokerages

Discount brokerage Proprio Direct was fined in 2001 for practices not inline with the province's real estate code of ethics. Proprio Direct charged a flat fee up front in order to sell a client's property. This type of fee is not inline with the real estate association standard of a percent of the selling price of a property, after the sale is complete. The Montreal based firm has fought the fines every step of the way, and now the decision is going to the Supreme Court. Use a real estate website and save thousands is what I would say. The full article can be found at Canada.com.

Tuesday, November 14, 2006

What Can You Do To Reduce Debt?

In order to buy a house most of us need a mortgage. With a mortgage comes interest. Over the 25 or 30 years that you are making mortgage payments you may pay for your home several times over because of interest. It is not something we like to think about, because it feels like throwing money away. I have found a very interesting article on debt, and what we can do to get out from under it. On the other hand, paying rent every month feels like throwing money away as well. At least with a mortgage you have some equity in your home, and hopefully the home's value increases over time. So whether you choose to buy a home with a mortgage, or to rent. Be wise with your money. Currently in British Columbia the market has begun to cool off, so maybe more of you will be able to buy homes in the future.

Heads up folks. Tomorrow, November 15, is the deadline for submissions to Canadian Real Estate eBook: Top 100 Websites. Click Here to Submit.

Heads up folks. Tomorrow, November 15, is the deadline for submissions to Canadian Real Estate eBook: Top 100 Websites. Click Here to Submit.

Wednesday, November 08, 2006

Snap Up Real Estate Has New Advertising Partners

Recently Snap Up Real Estate has partnered with Point2Agent real estate software to increase traffic to our website www.SnapUpRealEstate.ca. You can check out our home page with Point2Agent to see what kind of service they provide. As well we continue to have advertisers Wholesale Furniture Brokers and SilverServers listed on Snap Up Real Estate. If you would like to partner with one of the most affordable real estate sites try our advertising page. LSBlogs has also recently partnered with The Canadian Real Estate Blog with a new directory listing.

And now for our featured listing: "A Nature Lover's Paradise"

"A Nature Lover's Paradise"

This Property is located in Bella Coola, B.C. and has a wonderful rustic cedar home, and 74 acres of prime wilderness. The full property description will blow your mind. This property is a steal at $565,000 CAD.

And now for our featured listing:

"A Nature Lover's Paradise"

"A Nature Lover's Paradise"This Property is located in Bella Coola, B.C. and has a wonderful rustic cedar home, and 74 acres of prime wilderness. The full property description will blow your mind. This property is a steal at $565,000 CAD.

Thursday, November 02, 2006

Snap Up Real Estate Now Has A Profile At HelloVancouver.com

In the interest of marketing Snap Up Real Estate we have uploaded our company profile to HelloVancouver website. While at the website you can visit our profile, and check out other interesting sites as well.

Snap Up Real Estate is also launching an eBook. If you think that your real estate company should be included in "Canadian Real Estate: Top 100 Websites", then contact us, or go to our web page for more info. The eBook will focus on only the best websites available in Canada, and will be available at the end of November.

Snap Up Real Estate is also launching an eBook. If you think that your real estate company should be included in "Canadian Real Estate: Top 100 Websites", then contact us, or go to our web page for more info. The eBook will focus on only the best websites available in Canada, and will be available at the end of November.

Tuesday, October 31, 2006

The World's Largest Property Company By Capital Is Building The World's Tallest Tower In Dubai

Emaar, which is listed on the Dubai stock exchange, is building its flagship project called 'Burj Dubai' or Dubai Tower to a staggering 700 meters (2,296 feet) and more than 160 stories. This mammoth tower, the centerpiece of a 20-billion-dollar venture featuring the construction of a new district, "Downtown Burj Dubai," will house 30,000 apartments and the world's largest shopping mall. The tower alone will cost over 1 Billion, and at the height of construction could have 20,000 workers on site. Toronto's CN Tower will be dwarfed by this new project, as well as others planned for Southeast Asia.

Friday, October 27, 2006

You Can Sink Or Swim In The Real Estate Market

You can sink or swim in the real estate market. Brothers Joseph and Wolf Lebovic must be swimming quite well. The two brothers donated $50 million to Toronto's Mount Sinai Hospital this month. The Lebovics moved to Canada from Hungary after WWII and made their mark on the real estate market. Check CBC.ca for the full story.

CBC.ca also has an informative real estate series available on their website. The content is becoming a little dated, but spring of 2006 was no that long ago. The series mostly focuses on Vancouver real estate.

CBC.ca also has an informative real estate series available on their website. The content is becoming a little dated, but spring of 2006 was no that long ago. The series mostly focuses on Vancouver real estate.

Tuesday, October 24, 2006

Alberta Residents Of Old Neigbourhoods Are Concerned For Heritage Buildings

People who live in the older parts of cities like Edmonton are worried the old homes, some of which are over 100 years old, are being torn down without consideration. Some cities have historical boards which prevent the demolition of heritage sites, but with so many buildings it is hard to save them all. With the real estate frenzy that is occurring places like Calgary and Edmonton it is hard for owners to turn down hundreds of thousands of dollars for dilapidated old homes.

Friday, October 20, 2006

Snap Up Real Estate Highlights Of The Week

Lets have a look at this week's Highlighted properties.

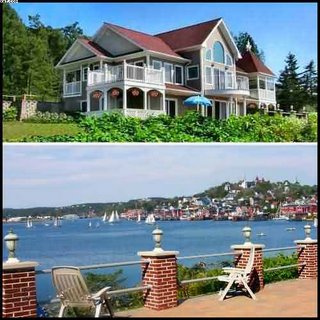

This week we go to Prince Edward Island to visit a custom built island masterpiece. This home is only 2 years old and features 6 bedrooms and 5 bathrooms. This home is offered fully furnished at $1,600,000 USD. Not a bad pick if you enjoy Canada's potato paradise. Full Listing Details.

Also available is a retirement getaway, or vacation retreat, in stunning Kaslo, British Columbia. This home is almost new and features 3 bedrooms, 3 bathroom, and an enormous wrap around sundeck. This home is located in the majestic forests of the Kootenays. Full Listing Details.

home is almost new and features 3 bedrooms, 3 bathroom, and an enormous wrap around sundeck. This home is located in the majestic forests of the Kootenays. Full Listing Details.

This week we go to Prince Edward Island to visit a custom built island masterpiece. This home is only 2 years old and features 6 bedrooms and 5 bathrooms. This home is offered fully furnished at $1,600,000 USD. Not a bad pick if you enjoy Canada's potato paradise. Full Listing Details.

Also available is a retirement getaway, or vacation retreat, in stunning Kaslo, British Columbia. This

home is almost new and features 3 bedrooms, 3 bathroom, and an enormous wrap around sundeck. This home is located in the majestic forests of the Kootenays. Full Listing Details.

home is almost new and features 3 bedrooms, 3 bathroom, and an enormous wrap around sundeck. This home is located in the majestic forests of the Kootenays. Full Listing Details.

Tuesday, October 17, 2006

I Have Discovered A Very Interesting, And Possibly Very Useful, Marketing Tool For Real Estate Agents

I have discovered a very interesting, and possibly very useful, marketing tool for real estate agents. www.MoneyMaker4Agents.com offers full service real estate web sites for real estate agents and brokers. You may say "big deal", but this service is truly worth the $50 per month fee. I have signed up for a free 30 day trial to evaluate the service, and so far I am very impressed. They assign you your own web page, such as www.bartzirnhelt.mm4a.com. With your web page you can customize the appearance with a myriad of options. It is very easy to upload company logos and edit your personal profile with pictures, opening comments, and disclaimers. Stay tuned for more updates on this impressive service.

Friday, October 13, 2006

Business Edge News Has Some Insight On The Canadian Real Estate Market

The recent nation wide real estate boom has produced new real estate spin-off jobs such as: real estate agents, home inspectors, mortgage brokers, and construction workers. In the last few months the real estate market has drastically cooled in Eastern Canada, and places like Toronto and Montreal are in a regressive market.

Benjamin Tal, a CIBC World Markets analyst states "We'll probably see some slowing...there is a booming bubble, especially in Ontario and the East. I think we have to recognize that's the case. I think that we'll see less real estate agents, less home inspectors."

He says Ontario's real estate market will struggle because of the high Canadian dollar, a decline in manufacturing and the province's proximity to the struggling U.S. market.

Fortunately for those of us in the west the real estate market will remain steady due to oil and gas speculation in Alberta, along with the 2010 Olympics in Vancouver.

Benjamin Tal, a CIBC World Markets analyst states "We'll probably see some slowing...there is a booming bubble, especially in Ontario and the East. I think we have to recognize that's the case. I think that we'll see less real estate agents, less home inspectors."

He says Ontario's real estate market will struggle because of the high Canadian dollar, a decline in manufacturing and the province's proximity to the struggling U.S. market.

Fortunately for those of us in the west the real estate market will remain steady due to oil and gas speculation in Alberta, along with the 2010 Olympics in Vancouver.

Wednesday, October 11, 2006

Calgary And Edmonton Continue To Have Phenomenal Increases In Property Values

Calgary and Edmonton continue to have phenomenal increases in property values. Edmonton has seen increases on average of 50 percent over the same time last year, and inventory is starting to grow a little bit. Calgary is also near the 50 percent mark on increased property values over last year. These increases are directly attributed to Alberta's economic status as the oil and gas epicenter of Canada.

With housing prices increasing in all major markets across Canada real estate agents and their marketing tool MLS are having problems. Full service agents are accusing discount brokerages, those who operate mainly online, on flooding the MLS network with inaccurate listings. The battle has gone to the CREA, but more studies are yet to be done on whether limiting access to MLS is in the cards.

With housing prices increasing in all major markets across Canada real estate agents and their marketing tool MLS are having problems. Full service agents are accusing discount brokerages, those who operate mainly online, on flooding the MLS network with inaccurate listings. The battle has gone to the CREA, but more studies are yet to be done on whether limiting access to MLS is in the cards.

Friday, October 06, 2006

Tools You Can Use For Buying And Selling Real Estate

John T. Reed has reviews of real estate investment gurus from Abalos to Young. Some gurus are labeled as useful, while most are given the heave into the useless pile. One investment guru, Russ Whitney, draws particular ire from Reed, as he dedicates an entire site to him.

Mortgage Calculators

Mortgage calculators are a very useful tool. They can tell you what you payments would be, how much money you need to make to afford a particular home, and your Debt Service Ratio. Use caution as the answers can be unsettling.

Renovation

Renovating homes is a very popular way to make a dingy house or condo look new again. Of course you must be wary of the 'bad contractor'. Renomark.ca Offers advice on how to pick a good contractor and where to find one.

High End Real Estate

Virani Real Estate advisors specialize in high end real estate in the Vancouver and Lower Mainland market. Their website is fantastic, with endless pictures, and scads of million plus featured real estate. Check the site out and drool over what you would buy for 5 million.

Friday, September 29, 2006

A Quick Glance At Real Estate Markets

Australia

Real estate in Australia often shows what trends will happen in the US, as they have been the global leader since 2000. Australian real estate has not had its 'bubble burst', as most expect is happening in the US. The US may only slide a little as they step up the 'War on Terror'

Canada - Ottawa

Ottawa, and all of Ontario, has a very stable real estate environment, as the home of the country's capital should. An average home sells for less than $300,000 and the government will always we around to provide steady jobs. 'Canada's housing market is likely to outperform the

American market through 2007'.

Canada - Vancouver

Real estate in Vancouver is insane. You need to make over $100,000 per year to buy a decent place to live. The Globe and Mail took a regular couple who is interested in buying a home and broke down their finances, and possibly their spirits. The couple is a doctor and a teacher, and in the end they cannot afford to buy in the current market.

US - Andre Agassi

Andre and Steffi have decided to spend their millions instead of living the easy life. Agassi Graf Development LLC plans to develop a luxury ski resort in Idaho. They plan to sell one beroom condo's for $800,000 a piece. That is more than Whistler, the site of 2010 Olympics. Good luck to them.

Real estate in Australia often shows what trends will happen in the US, as they have been the global leader since 2000. Australian real estate has not had its 'bubble burst', as most expect is happening in the US. The US may only slide a little as they step up the 'War on Terror'

Canada - Ottawa

Ottawa, and all of Ontario, has a very stable real estate environment, as the home of the country's capital should. An average home sells for less than $300,000 and the government will always we around to provide steady jobs. 'Canada's housing market is likely to outperform the

American market through 2007'.

Canada - Vancouver

Real estate in Vancouver is insane. You need to make over $100,000 per year to buy a decent place to live. The Globe and Mail took a regular couple who is interested in buying a home and broke down their finances, and possibly their spirits. The couple is a doctor and a teacher, and in the end they cannot afford to buy in the current market.

US - Andre Agassi

Andre and Steffi have decided to spend their millions instead of living the easy life. Agassi Graf Development LLC plans to develop a luxury ski resort in Idaho. They plan to sell one beroom condo's for $800,000 a piece. That is more than Whistler, the site of 2010 Olympics. Good luck to them.

Tuesday, September 19, 2006

The Battle For Home Owners To Be Able To Sell Their Homes At A Discount Rate Is Heating Up

I have posted the entire article as Globe links tend to get removed. The battle for home owners to be able to sell their homes at a discount rate is heating up.

Realtors battle over access to listing service

Paul Waldie and Jane Gadd

Monday, September 18, 2006

A battle is brewing behind the scenes of Canada's booming real estate market that could change the way homes are sold in this country and hike fees consumers pay for some real estate agent services.

The dispute centres around the use of the Multiple Listing Service and it pits so-called full-service realtors against discount brokers who operate largely on-line and charge far lower commissions.

Full-service brokers want to tighten the rules governing how agents list homes on MLS. They say the system has been flooded with properties from discount brokers who provide few real estate services and simply list houses on MLS for a fee. They argue that has diluted the effectiveness of MLS and led to inaccurate information for buyers.

Discount brokers counter by saying their rivals are trying to change the rules in order to protect their lucrative commissions, typically 5 per cent of the sale price of a house. The discount agents argue they offer consumers an important choice about how to sell their home.

"The changes [to the MLS] will definitely hinder our business," said Ian Martin, chief executive officer of Vancouver's Erealty.ca, which charges a commission of 0.5 per cent on a sale. "But also it's going to end up costing the consumer, our clients, more money."

While the debate had raged largely among real estate agents, the Competition Bureau has entered the fray by expressing concern about the proposed changes, saying they could be anti-competitive.

The MLS system has been around for more than 50 years. It started as a way for agents to share information about homes for sale and it has become a key resource for realtors, buyers and sellers. Only real estate agents can list properties on MLS and local real estate boards operate the service in their market.

The debate about changing MLS access started in July when the Canadian Real Estate Association's board of directors proposed amendments to the rules governing listings. The 86,000-member group, which is dominated by full-service realtors, owns the MLS trademark.

At the time, the board said it was acting to protect the MLS trademark, which it said had become undermined by listings that "did not require sufficient realtor involvement in the transaction."

Under the board's proposals, agents would have to inspect a home before it could be listed and agree to work with other realtors throughout the sale process, including arranging compensation. The proposals will be voted on by delegates to a special assembly this week in Halifax.

The Competition Bureau has reviewed the proposals and in a letter to the CREA last month, the bureau said it had trouble understanding why they were needed given that the MLS trademark did not appear to be under threat. The bureau added that it has concerns about rules "that serve to exclude entry-only and limited-service listing from MLS or otherwise restrict the ability of consumers to obtain the variety of relationships that they want with a broker."

Many realtors say the proposed changes were aimed largely at companies such as Realtysellers, which operates mainly in Ontario and specializes in helping people sell their home themselves. For a fee of $695, Realtysellers will list a home for sale on MLS and direct inquiries to the seller. The seller then handles the sale and decides how much of a commission, if any, to pay the buyer's broker.David Pearce, a former long-time director of the Toronto Real Estate Board (TREB), says putting restrictions on MLS isn't good for competition. Mr. Pearce, who runs Re/Max Rouge River Realty, doesn't like flat-fee services that dump properties on to MLS, but he said consumers have a right to decide. "Just because I think it's a dumb business plan, why should I care?" he said. "Let [other realtors] do it."

Last month, the directors of the TREB voted to reject the CREA's proposed changes. In a letter to the association, TREB president Dorothy Mason said the proposals raise serious concerns and require more consultation. Directors of the Greater Montreal Real Estate Board have also asked to have the proposals withdrawn. However, many agents and real estate boards in Western Canada, where the market has been extremely strong, favour the proposed changes.

Bob Linney, a spokesman for the CREA, said the proposals are designed to protect the trademark. "It's entirely a trademark issue. It is not aimed at any one particular business model," he said. "Fees are always negotiable."

As for the Competition Bureau, Mr. Linney said the association has "an ongoing dialogue" with the bureau about a range of issues. It also has a legal opinion that says its proposed changes will not restrict competition.

Mr. Linney added that delegates will have the final say at the meeting in Halifax. "Nothing has been decided and we don't want to comment until it has been decided."

© The Globe and Mail

Realtors battle over access to listing service

Paul Waldie and Jane Gadd

Monday, September 18, 2006

A battle is brewing behind the scenes of Canada's booming real estate market that could change the way homes are sold in this country and hike fees consumers pay for some real estate agent services.

The dispute centres around the use of the Multiple Listing Service and it pits so-called full-service realtors against discount brokers who operate largely on-line and charge far lower commissions.

Full-service brokers want to tighten the rules governing how agents list homes on MLS. They say the system has been flooded with properties from discount brokers who provide few real estate services and simply list houses on MLS for a fee. They argue that has diluted the effectiveness of MLS and led to inaccurate information for buyers.

Discount brokers counter by saying their rivals are trying to change the rules in order to protect their lucrative commissions, typically 5 per cent of the sale price of a house. The discount agents argue they offer consumers an important choice about how to sell their home.

"The changes [to the MLS] will definitely hinder our business," said Ian Martin, chief executive officer of Vancouver's Erealty.ca, which charges a commission of 0.5 per cent on a sale. "But also it's going to end up costing the consumer, our clients, more money."

While the debate had raged largely among real estate agents, the Competition Bureau has entered the fray by expressing concern about the proposed changes, saying they could be anti-competitive.

The MLS system has been around for more than 50 years. It started as a way for agents to share information about homes for sale and it has become a key resource for realtors, buyers and sellers. Only real estate agents can list properties on MLS and local real estate boards operate the service in their market.

The debate about changing MLS access started in July when the Canadian Real Estate Association's board of directors proposed amendments to the rules governing listings. The 86,000-member group, which is dominated by full-service realtors, owns the MLS trademark.

At the time, the board said it was acting to protect the MLS trademark, which it said had become undermined by listings that "did not require sufficient realtor involvement in the transaction."

Under the board's proposals, agents would have to inspect a home before it could be listed and agree to work with other realtors throughout the sale process, including arranging compensation. The proposals will be voted on by delegates to a special assembly this week in Halifax.

The Competition Bureau has reviewed the proposals and in a letter to the CREA last month, the bureau said it had trouble understanding why they were needed given that the MLS trademark did not appear to be under threat. The bureau added that it has concerns about rules "that serve to exclude entry-only and limited-service listing from MLS or otherwise restrict the ability of consumers to obtain the variety of relationships that they want with a broker."

Many realtors say the proposed changes were aimed largely at companies such as Realtysellers, which operates mainly in Ontario and specializes in helping people sell their home themselves. For a fee of $695, Realtysellers will list a home for sale on MLS and direct inquiries to the seller. The seller then handles the sale and decides how much of a commission, if any, to pay the buyer's broker.David Pearce, a former long-time director of the Toronto Real Estate Board (TREB), says putting restrictions on MLS isn't good for competition. Mr. Pearce, who runs Re/Max Rouge River Realty, doesn't like flat-fee services that dump properties on to MLS, but he said consumers have a right to decide. "Just because I think it's a dumb business plan, why should I care?" he said. "Let [other realtors] do it."

Last month, the directors of the TREB voted to reject the CREA's proposed changes. In a letter to the association, TREB president Dorothy Mason said the proposals raise serious concerns and require more consultation. Directors of the Greater Montreal Real Estate Board have also asked to have the proposals withdrawn. However, many agents and real estate boards in Western Canada, where the market has been extremely strong, favour the proposed changes.

Bob Linney, a spokesman for the CREA, said the proposals are designed to protect the trademark. "It's entirely a trademark issue. It is not aimed at any one particular business model," he said. "Fees are always negotiable."

As for the Competition Bureau, Mr. Linney said the association has "an ongoing dialogue" with the bureau about a range of issues. It also has a legal opinion that says its proposed changes will not restrict competition.

Mr. Linney added that delegates will have the final say at the meeting in Halifax. "Nothing has been decided and we don't want to comment until it has been decided."

© The Globe and Mail

Snap Up Real Estate's Press Release Is Now Available At www.PR.com

Snap Up Real Estate's Press Release is now available at www.PR.com

Snap Up Real Estate recently launched a new real estate web site, and the Press Release has been published on PR.com. The release focuses on Snap Up Real Estate's entry into a tough real estate market, and emphasizes how and why the new company will succeed.

Snap Up Real Estate recently launched a new real estate web site, and the Press Release has been published on PR.com. The release focuses on Snap Up Real Estate's entry into a tough real estate market, and emphasizes how and why the new company will succeed.

Thursday, September 14, 2006

Snap Up Real Estate Is The Newest Online Real Estate Web Portal

Snap Up Real Estate is the Newest Online Real Estate Web Portal.

PRweb issued a release earlier this week concerning the launch on the new Canadian firm.

The full article can be viewed as a download or online.

Attached to the press release is a PodCast with the Operating Manager of Snap Up Real Estate, Bart Zirnhelt.

Friday, September 08, 2006

Lets Take A Look At What Is For Sale In Canada's Smaller Real Estate Markets

Lets take a look at what is for sale in Canada's smaller real estate markets.

In the Yukon $499,000 gets you this log home on the Mclintock River in Whitehorse.

In the Yukon $499,000 gets you this log home on the Mclintock River in Whitehorse.

This log masterpiece features 2 bedrooms, 2 bathrooms, 2400 sq/ft or living area, radiant heat flooring, guest cabin and huge 24x26 garage. Not too bad if you like the long winters.

If Atlantic Canada is more your flavor perhaps this Home in Lunenburg, Nova Scotia will peak your interest.

You can check out the fantastic view from your 307 feet of ocean front, and enjoy your sail boat with the available deep mooring. All this goes for a cool $1.25 Million.

Finally lets take a look at what you can get for big money in Newfoundland and Labrador. For $1.375 Million you can get a 87 year old mansion in St. John's.

This home has 9 bedrooms, 9 1/2 bathrooms, 9 fireplaces, and 10 foot ceilings. A real piece of luxury on the Rock.

Friday, September 01, 2006

The United States Has Experienced A Downturn In It's Housing Market

The United States has experienced a downturn in it's housing market. Places like Florida have a vast number of condos for sale, but nobody left to buy them. Here in Canada the same problem should not occur. The following article shed to light on the housing question.

Vancouver, Calgary on realty slump watch

TD warns of 'flashing warning lights'

Housing markets in Western Canada are "flashing warning lights," and some cities might be on the cusp of a major price downturn, Toronto-Dominion Bank warns.

"There is no question that the recent dramatic price gains in Calgary and Vancouver are unsustainable, and that these urban centres are vulnerable to significant moderation, including the possibility of a pullback in prices at some point in the future," economists Craig Alexander and Steve Chan said in a note to clients yesterday.

The warning arrived just as the Canadian Real Estate Association reported that the number of home sales in Canada's major markets slipped 3.1 per cent in July from June.

Home sales through CREA's Multiple Listing Service in the first seven months of the year blew past all previous highs, and are on track to close the year with a new annual record. However, the association said a "marked increase in new listings in Alberta and the return to more normal levels of sales activity in British Columbia and Alberta" have left the national market "more balanced than it has been at any point in the past five years."

CREA's chief economist Gregory Klump said national sales are starting to come off record levels. "What is new this month is that there are signs that Vancouver and Calgary are starting to join that trend."

The TD economists acknowledge that housing activity in Western Canadian cities is easing a little, but say their real estate bubble-watch indicators suggest Calgary, Vancouver and Edmonton bear closer watching.

A series of weak U.S. data have generated worry that the slumping housing market south of the border will hobble U.S. economic growth. The concern is that Canada's real estate market will follow suit.

TD has consistently argued that Canada's real estate market has "generally lacked the degree of speculation that dominated past boom-bust cycles," and that excesses lag those evident in the United States.

The TD economists are sticking with that argument, but say they are concerned about certain pockets of the Canadian housing market.

The housing situation in Calgary, a city flush with oil money, has seen explosive growth in recent years, TD said. The city's housing situation has started to open up: Demand is easing, unit sales are weaker, new listings have picked up and the powerful sellers' market is showing signs of becoming more balanced.

"Given that the market is overheated at the moment, a bubble may be forming, or could easily develop, but the hope is that the trend toward a more balanced market continues," Mr. Alexander and Mr. Chan said.

The situation is similar in Edmonton, where robust demand and tight supply have fuelled a steep rise in prices. If the pace of price increases continues, a bubble could form, TD said. However, housing in Edmonton is still quite affordable, raising the chances of a soft landing.

In Vancouver, demand for housing is also softening, although that could be because the average resale home, at $509,606, is now the most expensive in Canada. Indications of weaker unit sales and rising listings suggest a soft landing, the TD economists said, but developments in the market need to be monitored.

The warning signs that TD sees in Western Canada are absent from the rest of the country.

"Other major Canadian real estate markets appear to be in much more balanced shape, and housing activity in Central and Atlantic Canada has already cooled without prompting a price correction -- supporting the view that a bubble never formed in these regions," the economists said.

Article by Roma Luciw of the Globe and Mail

Vancouver, Calgary on realty slump watch

TD warns of 'flashing warning lights'

Housing markets in Western Canada are "flashing warning lights," and some cities might be on the cusp of a major price downturn, Toronto-Dominion Bank warns.

"There is no question that the recent dramatic price gains in Calgary and Vancouver are unsustainable, and that these urban centres are vulnerable to significant moderation, including the possibility of a pullback in prices at some point in the future," economists Craig Alexander and Steve Chan said in a note to clients yesterday.

The warning arrived just as the Canadian Real Estate Association reported that the number of home sales in Canada's major markets slipped 3.1 per cent in July from June.

Home sales through CREA's Multiple Listing Service in the first seven months of the year blew past all previous highs, and are on track to close the year with a new annual record. However, the association said a "marked increase in new listings in Alberta and the return to more normal levels of sales activity in British Columbia and Alberta" have left the national market "more balanced than it has been at any point in the past five years."

CREA's chief economist Gregory Klump said national sales are starting to come off record levels. "What is new this month is that there are signs that Vancouver and Calgary are starting to join that trend."

The TD economists acknowledge that housing activity in Western Canadian cities is easing a little, but say their real estate bubble-watch indicators suggest Calgary, Vancouver and Edmonton bear closer watching.

A series of weak U.S. data have generated worry that the slumping housing market south of the border will hobble U.S. economic growth. The concern is that Canada's real estate market will follow suit.

TD has consistently argued that Canada's real estate market has "generally lacked the degree of speculation that dominated past boom-bust cycles," and that excesses lag those evident in the United States.

The TD economists are sticking with that argument, but say they are concerned about certain pockets of the Canadian housing market.

The housing situation in Calgary, a city flush with oil money, has seen explosive growth in recent years, TD said. The city's housing situation has started to open up: Demand is easing, unit sales are weaker, new listings have picked up and the powerful sellers' market is showing signs of becoming more balanced.

"Given that the market is overheated at the moment, a bubble may be forming, or could easily develop, but the hope is that the trend toward a more balanced market continues," Mr. Alexander and Mr. Chan said.

The situation is similar in Edmonton, where robust demand and tight supply have fuelled a steep rise in prices. If the pace of price increases continues, a bubble could form, TD said. However, housing in Edmonton is still quite affordable, raising the chances of a soft landing.

In Vancouver, demand for housing is also softening, although that could be because the average resale home, at $509,606, is now the most expensive in Canada. Indications of weaker unit sales and rising listings suggest a soft landing, the TD economists said, but developments in the market need to be monitored.

The warning signs that TD sees in Western Canada are absent from the rest of the country.

"Other major Canadian real estate markets appear to be in much more balanced shape, and housing activity in Central and Atlantic Canada has already cooled without prompting a price correction -- supporting the view that a bubble never formed in these regions," the economists said.

Article by Roma Luciw of the Globe and Mail

Wednesday, August 23, 2006

Professional Advice - Where Do I Invest In Real Estate?

The current conditions in the USA have created a dilemma for those of us north of the border. Where do I invest my money in real estate, especially if the market is uncertain. By investing in rental properties in your own area you leave yourself open to local market fluctuations, which also will effect your primary residence. You could invest in a community removed from the fluctuations that would effect your primary residence, but it is hard to be a efficient landlord if your property is many hours away. Perhaps the answer is a real estate fund.

Real Estate funds will charge a fee, but because they are much larger, money wise, their is more security. And you don't have middle of the night calls about a leaking hot water tank.

Real Estate Investment Trusts (REIT's) also have a great rate of return, but can be more volatile.

Returns of REIT's can be as high as 30%, and returns on Real Estate fund are a more conservative 15%.

Experts say diversity is the KEY.

The Globe and Mail has the full article.

Real Estate funds will charge a fee, but because they are much larger, money wise, their is more security. And you don't have middle of the night calls about a leaking hot water tank.

Real Estate Investment Trusts (REIT's) also have a great rate of return, but can be more volatile.

Returns of REIT's can be as high as 30%, and returns on Real Estate fund are a more conservative 15%.

Experts say diversity is the KEY.

The Globe and Mail has the full article.

Friday, August 11, 2006

Since You Need A Lawyer At Some Point In Your Real Estate Transaction, Why Not Start With One

Since you need a lawyer at some point in your real estate transaction, why not start with one. A team of lawyers in Eastern Canada has started a website were they handle all of your real estate needs. There is no need for a realtor and a lawyer. They are the same person. Read on to see how the firm also does good in the community.

Save money without realtors Innovative lawyers support GSC

(Aug 11, 2006)

Ten innovative lawyers have developed a new website in Hamilton to help people sell their homes without the need for a real estate broker. The website address is www.Propertyshop.ca.

"This allows home sellers to save thousands of dollars," said Christine M. Lewis, Hamilton spokesperson for the group behind the new project.

Sellers can list the details of their property on the website, add up to 20 pictures, as well as telephone and e-mail information. There is even a link to a map, therefore potential purchasers can see were the property is located.

Propertyshop.ca also provides a lawn sign with the price on it and a telephone-number to a voice-box-system, where interested people can receive information about the property for sale.

The lawyers involved with the website help with legal advice during every step of the selling-process. Therefore, vendors have the security of a lawyer protecting his or her rights throughout the real-estate-deal. While traditional realtors make commissions of $10,000 to $12,000 on a $200,000 house, Propertyshop.ca would only take $600 to $800. This includes the internet-fee and the fee for the lawyer, although the fee for the legal advice is negotiable.

Vendors selling homes totally on their own and abandoning any professional advice often run into problems, according to Propertyshop.ca. Purchasers and vendors finalize deals at the kitchen table with little knowledge of drafting a contact. So, these deals often make little or no sense.

"That is where we, as lawyers, come in and draft the offers and make sure the deal is structured properly," said Ms. Lewis.

Finally consumers have two advantages using Propertyshop.ca. First they save money, and second, they get better legal advice by real lawyers instead of realtors.

In fact realtors would mostly help vendors in legal questions and advise the consumer that with all these complications, a professional broker is necessary.

"In reality, the client needs a lawyer for these issues," Ms. Lewis said. And the marketing can be done by the vendors themselves, using the website to promote the property.

The model has already proved successful in Scotland. The Canadian company said that in Edinburgh for example, the website did 93 per cent of all real-estate-transactions in that city.

Today there is also a successful branch in Glasgow.

To show its social interest, Propertyshop.ca has just started a program with the Good Shepherd Centres (GSC) in downtown Hamilton. From each house they help to sell they will give $300 to GSC to help families in need of housing support. To date, the company has housed one family, which cost $3,000.

"As the new champions of this program, they will provide sustainable support for our organization and give deserving families what they need to stay together," said Cathy Wellwood from the GSC.

Hamilton Propertyshop.ca, according to the firm's statement, is the largest location of this new concept of house-selling. The concept has already been successfully operating in Owen Sound for four years and now there are subsidiaries in Toronto, Thunder Bay Kingston, Sudbury, Kitchener, Cambridge, Waterloo, Sudbury, Sauble Beach, Chesley, Kincardine and Elmira.

From the Hamilton Mountain News

Save money without realtors Innovative lawyers support GSC

(Aug 11, 2006)

Ten innovative lawyers have developed a new website in Hamilton to help people sell their homes without the need for a real estate broker. The website address is www.Propertyshop.ca.

"This allows home sellers to save thousands of dollars," said Christine M. Lewis, Hamilton spokesperson for the group behind the new project.

Sellers can list the details of their property on the website, add up to 20 pictures, as well as telephone and e-mail information. There is even a link to a map, therefore potential purchasers can see were the property is located.

Propertyshop.ca also provides a lawn sign with the price on it and a telephone-number to a voice-box-system, where interested people can receive information about the property for sale.

The lawyers involved with the website help with legal advice during every step of the selling-process. Therefore, vendors have the security of a lawyer protecting his or her rights throughout the real-estate-deal. While traditional realtors make commissions of $10,000 to $12,000 on a $200,000 house, Propertyshop.ca would only take $600 to $800. This includes the internet-fee and the fee for the lawyer, although the fee for the legal advice is negotiable.

Vendors selling homes totally on their own and abandoning any professional advice often run into problems, according to Propertyshop.ca. Purchasers and vendors finalize deals at the kitchen table with little knowledge of drafting a contact. So, these deals often make little or no sense.

"That is where we, as lawyers, come in and draft the offers and make sure the deal is structured properly," said Ms. Lewis.

Finally consumers have two advantages using Propertyshop.ca. First they save money, and second, they get better legal advice by real lawyers instead of realtors.

In fact realtors would mostly help vendors in legal questions and advise the consumer that with all these complications, a professional broker is necessary.

"In reality, the client needs a lawyer for these issues," Ms. Lewis said. And the marketing can be done by the vendors themselves, using the website to promote the property.

The model has already proved successful in Scotland. The Canadian company said that in Edinburgh for example, the website did 93 per cent of all real-estate-transactions in that city.

Today there is also a successful branch in Glasgow.

To show its social interest, Propertyshop.ca has just started a program with the Good Shepherd Centres (GSC) in downtown Hamilton. From each house they help to sell they will give $300 to GSC to help families in need of housing support. To date, the company has housed one family, which cost $3,000.

"As the new champions of this program, they will provide sustainable support for our organization and give deserving families what they need to stay together," said Cathy Wellwood from the GSC.

Hamilton Propertyshop.ca, according to the firm's statement, is the largest location of this new concept of house-selling. The concept has already been successfully operating in Owen Sound for four years and now there are subsidiaries in Toronto, Thunder Bay Kingston, Sudbury, Kitchener, Cambridge, Waterloo, Sudbury, Sauble Beach, Chesley, Kincardine and Elmira.

From the Hamilton Mountain News

Wednesday, August 09, 2006

What Would You Do With The Lottery 649 Winnings Of 42 Million?

That is how much the August 12 drawing is supposed to fetch.

There are several real estate options available to you. In the Kamloops, B.C. are you could spend a paltry 3 million on an estate is Westsyde. The compound consists of 12.75 acres, pool (of course), over 6500 sq/ft of living space, and that is just to start. Full property details are available.

If you intended to sink your winnings into the booming energy industry of Canada, then Calgary would be a good choice. In the Pumphill district of Calgary just under 5 million will get you a castle, with all the modern conveniences. This beauty was built in 1997 and boasts 8 bathrooms, indoor pool, and is an honest to goodness castle.

On the other hand, the center of the universe might be the best choice after a windfall like 42 million. In Toronto you could blow about a third of your winnings on a glass palace that comes in under 1 million per 1000 sq/ft. At 15 million your glass house would offer 18000 sq/ft of luxury including a pool, basketball court and a Family tower. Only pictures can explain what 15 million buys.

All of these properties sound fantastic and you can dream to your hearts content, or if you are in the mood for reality then try shopping for something on SnapUpRealEstate.ca.

Good luck to all you lotto aficionados.

There are several real estate options available to you. In the Kamloops, B.C. are you could spend a paltry 3 million on an estate is Westsyde. The compound consists of 12.75 acres, pool (of course), over 6500 sq/ft of living space, and that is just to start. Full property details are available.

If you intended to sink your winnings into the booming energy industry of Canada, then Calgary would be a good choice. In the Pumphill district of Calgary just under 5 million will get you a castle, with all the modern conveniences. This beauty was built in 1997 and boasts 8 bathrooms, indoor pool, and is an honest to goodness castle.

On the other hand, the center of the universe might be the best choice after a windfall like 42 million. In Toronto you could blow about a third of your winnings on a glass palace that comes in under 1 million per 1000 sq/ft. At 15 million your glass house would offer 18000 sq/ft of luxury including a pool, basketball court and a Family tower. Only pictures can explain what 15 million buys.

All of these properties sound fantastic and you can dream to your hearts content, or if you are in the mood for reality then try shopping for something on SnapUpRealEstate.ca.

Good luck to all you lotto aficionados.

Sunday, August 06, 2006

Apparently The Every Expanding And Limitless Internet Does Have Boundaries

Apparently the every expanding and limitless Internet does have boundaries. The English language has put imitations on the number of domain names that make sense. Therefore names that are simple and make sense are worth a lot of money. Dotster Inc. reports over 70 million domains names being snapped up. ( Names like SnapUpRealEstate.ca and SnapUpRealEstate.com).

The full article on the shortage, or perceived shortage, of domain names can be found in the Globe and Mail.

The full article on the shortage, or perceived shortage, of domain names can be found in the Globe and Mail.

Friday, August 04, 2006

The Queen Of England Has Been Stuck With A Derelict Property In Manchester Because Of A 607 Year Old Law

Here is a bit of odd real estate news. The Queen of England has been stuck with a derelict property in Manchester because of a 607 year old law. The law states that abandoned properties revert to the Queen. Locals are hoping their legal loophole will attract tourists.

The complete article is available at Yahoo! News.

The complete article is available at Yahoo! News.

Thursday, August 03, 2006

We Are Not The USA. But We Are Continually Running About The Elephants Feet, So Will We Get Crushed?

We are not the USA. But we are continually running about the elephants feet, so will we get crushed?

The housing market in the states is about to go POP. Hopefully that does not mean that Canada has to experience the same economic crisis. For too many home owners in the US, who capitalized on the low interest rates many many moons ago, the 17 straight rate hikes by the fed will force them to put their homes up for sale, as they cannot cover the mortgage at 7%.

Does this mean that Canada's real estate bubble will burst? Only time will tell, but with Western Canada booming perhaps real estate will only let out some air, and not burst.

The housing market in the states is about to go POP. Hopefully that does not mean that Canada has to experience the same economic crisis. For too many home owners in the US, who capitalized on the low interest rates many many moons ago, the 17 straight rate hikes by the fed will force them to put their homes up for sale, as they cannot cover the mortgage at 7%.

Does this mean that Canada's real estate bubble will burst? Only time will tell, but with Western Canada booming perhaps real estate will only let out some air, and not burst.

Tuesday, August 01, 2006

Real Estate Trends Help Chart Our Future

The Vancouver Island Real Estate Board recently released its buyer profile that not only helps realtors, sellers and buyers but also is useful to city planners, business owners and potential investors assisting us in charting the future.

Knowing the trends of people moving to Nanaimo will help with effective planning for our community in the future.

The buyer profile finds the two biggest trends continue to be an increasing number of retirees relocating to the Harbour City from other parts in Canada and people of all ages moving here from other Canadian cities.

The largest amount of buyers from out of province are Albertans at 11 per cent while 8.9 per cent of homes purchased in 2005 were bought by people moving from Ontario says VIREB President Darrel Paysen.

"Forty-six per cent of the buyers originate on Vancouver Island and 70 per cent originate from B.C., with the vast majority of buyers purchasing their principal residence in our city," he said.

"It's good to see what the long term trends are in terms of where people are coming from, what they're buying and why they're buying.

"It is useful information for all types of infrastructure planning."

Paysen said the buyer profile also fits perfectly with the principles of building better communities and encouraging economic vitality under the real estate industry's Quality of Life initiative.

Prices are up over the same time last year with March-to-March figures seeing a 23 per cent increase.

Forecast experts anticipate prices to continue to rise but at a softer incline than this past year. However, this may not apply to B.C.

With continued in-bound migration, demand for our natural resources, the Gateway to the Pacific initiative, supported by both the federal and provincial governments and, of course, the Olympics, B.C. may well continue strongly.

Despite increasing costs for housing, Nanaimo is still a great market for people to get into and our city has so much to offer. It is a great community for people of all ages with wonderful parks, recreation, schools, sporting facilities, senior's homes and shopping.

The cost of living in Nanaimo is considerably less than our neighbours in Victoria and Vancouver, yet offers all the amenities and comforts of a larger city.

Nanaimo is truly the most desirable liveable small city in North America.

This article can be viewed at SnapUpRealEstate.ca or Nanaimo News Bulletin

The energy boom in Alberta is creating new wealth, and people are looking for places to spend. Building a dream home in B.C. to retire in is at the top of the list for many retiring boomers in Alberta. Some recent developments on places like Pender Island do restrict the placement of dream homes.

Knowing the trends of people moving to Nanaimo will help with effective planning for our community in the future.

The buyer profile finds the two biggest trends continue to be an increasing number of retirees relocating to the Harbour City from other parts in Canada and people of all ages moving here from other Canadian cities.

The largest amount of buyers from out of province are Albertans at 11 per cent while 8.9 per cent of homes purchased in 2005 were bought by people moving from Ontario says VIREB President Darrel Paysen.

"Forty-six per cent of the buyers originate on Vancouver Island and 70 per cent originate from B.C., with the vast majority of buyers purchasing their principal residence in our city," he said.

"It's good to see what the long term trends are in terms of where people are coming from, what they're buying and why they're buying.

"It is useful information for all types of infrastructure planning."

Paysen said the buyer profile also fits perfectly with the principles of building better communities and encouraging economic vitality under the real estate industry's Quality of Life initiative.

Prices are up over the same time last year with March-to-March figures seeing a 23 per cent increase.

Forecast experts anticipate prices to continue to rise but at a softer incline than this past year. However, this may not apply to B.C.

With continued in-bound migration, demand for our natural resources, the Gateway to the Pacific initiative, supported by both the federal and provincial governments and, of course, the Olympics, B.C. may well continue strongly.

Despite increasing costs for housing, Nanaimo is still a great market for people to get into and our city has so much to offer. It is a great community for people of all ages with wonderful parks, recreation, schools, sporting facilities, senior's homes and shopping.

The cost of living in Nanaimo is considerably less than our neighbours in Victoria and Vancouver, yet offers all the amenities and comforts of a larger city.

Nanaimo is truly the most desirable liveable small city in North America.

This article can be viewed at SnapUpRealEstate.ca or Nanaimo News Bulletin

The energy boom in Alberta is creating new wealth, and people are looking for places to spend. Building a dream home in B.C. to retire in is at the top of the list for many retiring boomers in Alberta. Some recent developments on places like Pender Island do restrict the placement of dream homes.

Friday, July 28, 2006

Edmonton's Apartment Vacancy Rate Has Fallen From 4.5 Per Cent To 1.5 Per Cent In The Past Six Months

'Edmonton's apartment vacancy rate has fallen from 4.5 per cent to 1.5 per cent in the past six months, making it tougher to find a place to rent.

Commercial real estate company CB Richard Ellis surveyed over 30,000 apartments and found only about 500 vacancies.

Vice-president Paul Gemmel expects the rental market will only get tighter.

"The general economy is so strong. There's no new rental being built, it's not affordable, you can't build these things and make sense out of them," he said.

"I think we're going to see a real tight market here for the next several years."

After years of stability, rents have taken a 13 per cent jump. The average one-bedroom now rents for about $650 dollars a month.

Calgary's vacancy rate is 1.6 per cent.'

Taken from Yahoo! News

This is great news for investors. Buy up those revenue properties and ensure the energy boom in northern Alberta hits you nicely in the pocketbook.

Commercial real estate company CB Richard Ellis surveyed over 30,000 apartments and found only about 500 vacancies.

Vice-president Paul Gemmel expects the rental market will only get tighter.

"The general economy is so strong. There's no new rental being built, it's not affordable, you can't build these things and make sense out of them," he said.

"I think we're going to see a real tight market here for the next several years."

After years of stability, rents have taken a 13 per cent jump. The average one-bedroom now rents for about $650 dollars a month.

Calgary's vacancy rate is 1.6 per cent.'

Taken from Yahoo! News

This is great news for investors. Buy up those revenue properties and ensure the energy boom in northern Alberta hits you nicely in the pocketbook.

Thursday, July 27, 2006

Resale Of Homes In Major Cities On Pace To Set A Record This Year

"Resale of homes in major cities on pace to set a record this year: MLS agents

OTTAWA (CP) - It's a good year to sell your house.

The Canadian Real Estate Association says resales of homes by agents on the multiple listing service set a record for the first six months of this year and are on pace to set an annual record.

Actual resales of homes in major centres hit 186,177 units in the first half of the year, up 3.6 per cent from the same period last year.

The association says record sales in Calgary and Edmonton remained the driving force behind national totals, but records were also set in Regina, Saskatoon, Winnipeg, London and Sudbury in Ontario, Ottawa, Montreal and Quebec City.

The average price for the first six months hit $277,380, compared with $246,093 in the same period last year, a 12.7 per cent gain.

The total dollar volume for the first half of this year was $54.6 billion, up from $47.2 billion in 2005."

Article care of CBC.ca

This is great news for those of you who thought you had missed your chance at cashing in, and great for investors holding property as well.

OTTAWA (CP) - It's a good year to sell your house.

The Canadian Real Estate Association says resales of homes by agents on the multiple listing service set a record for the first six months of this year and are on pace to set an annual record.

Actual resales of homes in major centres hit 186,177 units in the first half of the year, up 3.6 per cent from the same period last year.

The association says record sales in Calgary and Edmonton remained the driving force behind national totals, but records were also set in Regina, Saskatoon, Winnipeg, London and Sudbury in Ontario, Ottawa, Montreal and Quebec City.

The average price for the first six months hit $277,380, compared with $246,093 in the same period last year, a 12.7 per cent gain.

The total dollar volume for the first half of this year was $54.6 billion, up from $47.2 billion in 2005."

Article care of CBC.ca

This is great news for those of you who thought you had missed your chance at cashing in, and great for investors holding property as well.

Tuesday, July 25, 2006

Real Estate In Northern B.C. Is Still Strong

"Realtors in northern B.C. have sold 3,432 properties through the MLS service in the first six months of the year. That is up 14 per cent in the same period in 2005, according to the July 12 press release from the B.C. Northern Real Estate Board. "

A 14% jump in sales is great for the economy of Northern B.C. With expansion of tourism and the retirement of boomers the northern part of the province will likely experience growth well after 2010.

You can read the entire article at SnapUpRealEstate.ca

Or check out more stats at CREA.ca

A 14% jump in sales is great for the economy of Northern B.C. With expansion of tourism and the retirement of boomers the northern part of the province will likely experience growth well after 2010.

You can read the entire article at SnapUpRealEstate.ca

Or check out more stats at CREA.ca

Tuesday, July 18, 2006

Real Estate Is So Hot In China That It Is Pushing The Economic Growth Rate To Double Digits

Real Estate is so hot in China that it is pushing the economic growth rate to double digits. This extraordinary growth rate has China's economic watchdogs concerned rabid investment will result in defaulted loans. With high growth rates everyone wants to get in on the boom, which results in poor investment loans that eventually become defaulted. With China's economy being so large, and overseas investment pouring in, defaulted loans could seriously effect the world economy. SnapUpRealEstate.ca has the complete article.

Thursday, July 13, 2006

In Order To Have A Mortgage You Need To Have Home Insurance

Let us talk about insurance. In order to have a mortgage you need to have home insurance. But does your insurance cover all types of loss that you might expect? The Insurance Bureau of Canada, which represents more than 90 per cent of Canada's non-government home, car and business insurance, is advising B.C. homeowners to double-check their insurance coverage as soon as possible. The recent rise of forest fires in areas such as Williams Lake has IBC warning not to wait until there is a fire to get insurance, as it will be too late. Insurance companies will not issue new insurance to home owners if there is a fire within 50 km. Check out the Williams Lake Tribune for the full article.

Tuesday, July 11, 2006

Making Sense Of Real Estate Legal Fees

The Law Society has released new guidelines for the standards expected of a lawyer in a real estate transaction. They are expected to raise the bar (pardon the pun!). There is also a movement to encourage the use of standard fees in real estate law. They would be higher than today's typical fees. I support both efforts. Before getting cynical about greedy lawyers, hear me out. I don't practise real estate law, so I am fairly objective. I suspect that many clients don't appreciate the effort that goes into a real estate file. Your solicitor must review the agreement; explain it to you; do a search of title and review it; and prepare a requisition letter to address the issues raised by the agreement and the title search. He or she must deal with the inevitable problems (very time consuming!) that arise. It is said there are no more simple transactions. Next, the lawyer must obtain the mortgage instructions, follow up on various inquiries to ensure that you have good title; prepare documents for the other side and/or you to sign; meet with you to sign up the documents (and, more often than not, to explain to you for the first time the details of the mortgage that you agreed to give, despite the fact that those terms ought to have been explained to you when you got the mortgage from the bank or the broker); go to the bank to get certified cheques; and register the deal. Even after the deal is done, there is work to do -- ensuring any previous mortgages are removed from title. Real estate practice is staff-intensive. I have one assistant. It is not unusual for a real estate lawyer to have three. That's three times the overhead (desks, computers, software, salaries and benefits, rent, etc.) than I have to carry. There are a lot of real estate lawyers working very hard to keep in business. Years ago, fees were based on the selling price -- just like real estate commissions still are. The Competition Tribunal had a problem with that. Once the tariff disappeared, some lawyers started offering cut-rate fees in an attempt to build a practice. The result is that legal fees for real estate lawyers have gone down, yet costs have gone up. I think these rate-cutters fall into two categories. The first group is the people who are fairly new and are trying to establish a practice and reputation. Eventually, they realize they could earn more by working at Home Depot, so they raise their rates, but advertise their prices in a way that you think you are getting a better price than you actually are. They may say "$500 plus disbursements."Some items that some lawyers call disbursements are nothing more than hidden fees. Comparing prices from lawyer to lawyer becomes like comparing cellular phone rate plans. The second category represents the factories. These are firms where the staff do all the work and the lawyer's involvement in the file is very limited. These situations breed negligence claims and it is no surprise to know that, historically, real estate transactions cause the highest number of negligence claims against lawyers. Solicitors want to do a good job. However, fees that are too low for the time required to do a good job will leave the solicitor desperate to cut costs, which too often results in cutting corners.

By Ian Johncox

So now you know what your lawyer does for all that money you have forked over.

By Ian Johncox

So now you know what your lawyer does for all that money you have forked over.

Tuesday, July 04, 2006

Numbers Are Starting To Come In For June, And Predictions Are That Real Estate Has Begun To Slow

Numbers are starting to come in for June, and predictions are that real estate has begun to slow. Final numbers will take another day or so, but in Calgary, Canada's hottest real estate market, home sales have begun to slow. Of course that is a relative term. Home prices have risen $10,000 since May, and an incredible $125,000 since last June. Kevin Clark, President of the Calgary Real Estate Board, believes that the Calgary market will start to cool a little with an increase in the number of homes listed. Check out Shawn Logan's article in the Calgary Sun for all the numbers and details.

The change in the Calgary market will be welcome news to those who are still seeking a home, and to investors who are sniffing out good deals. However, the recent slow down may be an indication of a market that has grown way to fast and of course the dreaded housing bubble that analysts have been warning of. In an energy rich economy like Alberta the slow down is sure to be just the market leveling off.

The change in the Calgary market will be welcome news to those who are still seeking a home, and to investors who are sniffing out good deals. However, the recent slow down may be an indication of a market that has grown way to fast and of course the dreaded housing bubble that analysts have been warning of. In an energy rich economy like Alberta the slow down is sure to be just the market leveling off.

Tuesday, June 27, 2006

The Booming Real Estate Market Is Not A Phenomenon Solely Identified With The Okanagan Valley In This Province

This article is from the Kelowna Capital News

The booming real estate market is not a phenomenon solely identified with the Okanagan Valley in this province. It's happening right across B.C., and it has people both excited and apprehensive at the same time.

Why?

Because they have to ask themselves how long the upward swing in prices can continue.

When will the bottom fall out of the real estate market demand and what will happen then?

If you think about it, in Kelowna and the Westside, the demand and escalating price of real estate has little to do with economic growth, and everything to do with baby boomer generation retirement savings being deposited here.

It's no secret that when a house goes on the market here, potential buyers are eyeing up such properties from across western Canada, with the idea that it might be a retirement home investment.

Overall in B.C., the real estate market is abuzz across the Interior, while the Lower Mainland is pricing itself into the stratosphere of other major urban centres across North America.

We are entering into a new era in our country's history, the retirement phase of the baby boomer generation, which will have economic and social impacts like nothing we have experienced in our country before.

People are retiring with more money in their pockets than in previous generations and they are retiring at an earlier age. The strain that could put on our health system, the population growth pressures that places on city planners, and shortages of skilled workers in the labour market are some of the significant concerns already starting to take fold.

So while those housing prices continue to go up each year of late, the question you have to ask yourself is are you really getting ahead?

This article raises several points that have yet to be answered, the most important being: What will happen when the Boomer have retired. Will Canada's health care be over run, will salaries for vacated jobs go through the roof, thus forces the price of commodities up, and pushing the unfortunate down. Or maybe have the boomers retired will effect little in the scheme of this, with people living healthier longer. They do have to spend their money on something.

Time will tell.

The booming real estate market is not a phenomenon solely identified with the Okanagan Valley in this province. It's happening right across B.C., and it has people both excited and apprehensive at the same time.

Why?

Because they have to ask themselves how long the upward swing in prices can continue.

When will the bottom fall out of the real estate market demand and what will happen then?

If you think about it, in Kelowna and the Westside, the demand and escalating price of real estate has little to do with economic growth, and everything to do with baby boomer generation retirement savings being deposited here.

It's no secret that when a house goes on the market here, potential buyers are eyeing up such properties from across western Canada, with the idea that it might be a retirement home investment.

Overall in B.C., the real estate market is abuzz across the Interior, while the Lower Mainland is pricing itself into the stratosphere of other major urban centres across North America.

We are entering into a new era in our country's history, the retirement phase of the baby boomer generation, which will have economic and social impacts like nothing we have experienced in our country before.

People are retiring with more money in their pockets than in previous generations and they are retiring at an earlier age. The strain that could put on our health system, the population growth pressures that places on city planners, and shortages of skilled workers in the labour market are some of the significant concerns already starting to take fold.

So while those housing prices continue to go up each year of late, the question you have to ask yourself is are you really getting ahead?

This article raises several points that have yet to be answered, the most important being: What will happen when the Boomer have retired. Will Canada's health care be over run, will salaries for vacated jobs go through the roof, thus forces the price of commodities up, and pushing the unfortunate down. Or maybe have the boomers retired will effect little in the scheme of this, with people living healthier longer. They do have to spend their money on something.

Time will tell.

Friday, June 23, 2006