Friday, September 29, 2006

A Quick Glance At Real Estate Markets

Australia

Real estate in Australia often shows what trends will happen in the US, as they have been the global leader since 2000. Australian real estate has not had its 'bubble burst', as most expect is happening in the US. The US may only slide a little as they step up the 'War on Terror'

Canada - Ottawa

Ottawa, and all of Ontario, has a very stable real estate environment, as the home of the country's capital should. An average home sells for less than $300,000 and the government will always we around to provide steady jobs. 'Canada's housing market is likely to outperform the

American market through 2007'.

Canada - Vancouver

Real estate in Vancouver is insane. You need to make over $100,000 per year to buy a decent place to live. The Globe and Mail took a regular couple who is interested in buying a home and broke down their finances, and possibly their spirits. The couple is a doctor and a teacher, and in the end they cannot afford to buy in the current market.

US - Andre Agassi

Andre and Steffi have decided to spend their millions instead of living the easy life. Agassi Graf Development LLC plans to develop a luxury ski resort in Idaho. They plan to sell one beroom condo's for $800,000 a piece. That is more than Whistler, the site of 2010 Olympics. Good luck to them.

Real estate in Australia often shows what trends will happen in the US, as they have been the global leader since 2000. Australian real estate has not had its 'bubble burst', as most expect is happening in the US. The US may only slide a little as they step up the 'War on Terror'

Canada - Ottawa

Ottawa, and all of Ontario, has a very stable real estate environment, as the home of the country's capital should. An average home sells for less than $300,000 and the government will always we around to provide steady jobs. 'Canada's housing market is likely to outperform the

American market through 2007'.

Canada - Vancouver

Real estate in Vancouver is insane. You need to make over $100,000 per year to buy a decent place to live. The Globe and Mail took a regular couple who is interested in buying a home and broke down their finances, and possibly their spirits. The couple is a doctor and a teacher, and in the end they cannot afford to buy in the current market.

US - Andre Agassi

Andre and Steffi have decided to spend their millions instead of living the easy life. Agassi Graf Development LLC plans to develop a luxury ski resort in Idaho. They plan to sell one beroom condo's for $800,000 a piece. That is more than Whistler, the site of 2010 Olympics. Good luck to them.

Tuesday, September 19, 2006

The Battle For Home Owners To Be Able To Sell Their Homes At A Discount Rate Is Heating Up

I have posted the entire article as Globe links tend to get removed. The battle for home owners to be able to sell their homes at a discount rate is heating up.

Realtors battle over access to listing service

Paul Waldie and Jane Gadd

Monday, September 18, 2006

A battle is brewing behind the scenes of Canada's booming real estate market that could change the way homes are sold in this country and hike fees consumers pay for some real estate agent services.

The dispute centres around the use of the Multiple Listing Service and it pits so-called full-service realtors against discount brokers who operate largely on-line and charge far lower commissions.

Full-service brokers want to tighten the rules governing how agents list homes on MLS. They say the system has been flooded with properties from discount brokers who provide few real estate services and simply list houses on MLS for a fee. They argue that has diluted the effectiveness of MLS and led to inaccurate information for buyers.

Discount brokers counter by saying their rivals are trying to change the rules in order to protect their lucrative commissions, typically 5 per cent of the sale price of a house. The discount agents argue they offer consumers an important choice about how to sell their home.

"The changes [to the MLS] will definitely hinder our business," said Ian Martin, chief executive officer of Vancouver's Erealty.ca, which charges a commission of 0.5 per cent on a sale. "But also it's going to end up costing the consumer, our clients, more money."

While the debate had raged largely among real estate agents, the Competition Bureau has entered the fray by expressing concern about the proposed changes, saying they could be anti-competitive.

The MLS system has been around for more than 50 years. It started as a way for agents to share information about homes for sale and it has become a key resource for realtors, buyers and sellers. Only real estate agents can list properties on MLS and local real estate boards operate the service in their market.

The debate about changing MLS access started in July when the Canadian Real Estate Association's board of directors proposed amendments to the rules governing listings. The 86,000-member group, which is dominated by full-service realtors, owns the MLS trademark.

At the time, the board said it was acting to protect the MLS trademark, which it said had become undermined by listings that "did not require sufficient realtor involvement in the transaction."

Under the board's proposals, agents would have to inspect a home before it could be listed and agree to work with other realtors throughout the sale process, including arranging compensation. The proposals will be voted on by delegates to a special assembly this week in Halifax.

The Competition Bureau has reviewed the proposals and in a letter to the CREA last month, the bureau said it had trouble understanding why they were needed given that the MLS trademark did not appear to be under threat. The bureau added that it has concerns about rules "that serve to exclude entry-only and limited-service listing from MLS or otherwise restrict the ability of consumers to obtain the variety of relationships that they want with a broker."

Many realtors say the proposed changes were aimed largely at companies such as Realtysellers, which operates mainly in Ontario and specializes in helping people sell their home themselves. For a fee of $695, Realtysellers will list a home for sale on MLS and direct inquiries to the seller. The seller then handles the sale and decides how much of a commission, if any, to pay the buyer's broker.David Pearce, a former long-time director of the Toronto Real Estate Board (TREB), says putting restrictions on MLS isn't good for competition. Mr. Pearce, who runs Re/Max Rouge River Realty, doesn't like flat-fee services that dump properties on to MLS, but he said consumers have a right to decide. "Just because I think it's a dumb business plan, why should I care?" he said. "Let [other realtors] do it."

Last month, the directors of the TREB voted to reject the CREA's proposed changes. In a letter to the association, TREB president Dorothy Mason said the proposals raise serious concerns and require more consultation. Directors of the Greater Montreal Real Estate Board have also asked to have the proposals withdrawn. However, many agents and real estate boards in Western Canada, where the market has been extremely strong, favour the proposed changes.

Bob Linney, a spokesman for the CREA, said the proposals are designed to protect the trademark. "It's entirely a trademark issue. It is not aimed at any one particular business model," he said. "Fees are always negotiable."

As for the Competition Bureau, Mr. Linney said the association has "an ongoing dialogue" with the bureau about a range of issues. It also has a legal opinion that says its proposed changes will not restrict competition.

Mr. Linney added that delegates will have the final say at the meeting in Halifax. "Nothing has been decided and we don't want to comment until it has been decided."

© The Globe and Mail

Realtors battle over access to listing service

Paul Waldie and Jane Gadd

Monday, September 18, 2006

A battle is brewing behind the scenes of Canada's booming real estate market that could change the way homes are sold in this country and hike fees consumers pay for some real estate agent services.

The dispute centres around the use of the Multiple Listing Service and it pits so-called full-service realtors against discount brokers who operate largely on-line and charge far lower commissions.

Full-service brokers want to tighten the rules governing how agents list homes on MLS. They say the system has been flooded with properties from discount brokers who provide few real estate services and simply list houses on MLS for a fee. They argue that has diluted the effectiveness of MLS and led to inaccurate information for buyers.

Discount brokers counter by saying their rivals are trying to change the rules in order to protect their lucrative commissions, typically 5 per cent of the sale price of a house. The discount agents argue they offer consumers an important choice about how to sell their home.

"The changes [to the MLS] will definitely hinder our business," said Ian Martin, chief executive officer of Vancouver's Erealty.ca, which charges a commission of 0.5 per cent on a sale. "But also it's going to end up costing the consumer, our clients, more money."

While the debate had raged largely among real estate agents, the Competition Bureau has entered the fray by expressing concern about the proposed changes, saying they could be anti-competitive.

The MLS system has been around for more than 50 years. It started as a way for agents to share information about homes for sale and it has become a key resource for realtors, buyers and sellers. Only real estate agents can list properties on MLS and local real estate boards operate the service in their market.

The debate about changing MLS access started in July when the Canadian Real Estate Association's board of directors proposed amendments to the rules governing listings. The 86,000-member group, which is dominated by full-service realtors, owns the MLS trademark.

At the time, the board said it was acting to protect the MLS trademark, which it said had become undermined by listings that "did not require sufficient realtor involvement in the transaction."

Under the board's proposals, agents would have to inspect a home before it could be listed and agree to work with other realtors throughout the sale process, including arranging compensation. The proposals will be voted on by delegates to a special assembly this week in Halifax.

The Competition Bureau has reviewed the proposals and in a letter to the CREA last month, the bureau said it had trouble understanding why they were needed given that the MLS trademark did not appear to be under threat. The bureau added that it has concerns about rules "that serve to exclude entry-only and limited-service listing from MLS or otherwise restrict the ability of consumers to obtain the variety of relationships that they want with a broker."

Many realtors say the proposed changes were aimed largely at companies such as Realtysellers, which operates mainly in Ontario and specializes in helping people sell their home themselves. For a fee of $695, Realtysellers will list a home for sale on MLS and direct inquiries to the seller. The seller then handles the sale and decides how much of a commission, if any, to pay the buyer's broker.David Pearce, a former long-time director of the Toronto Real Estate Board (TREB), says putting restrictions on MLS isn't good for competition. Mr. Pearce, who runs Re/Max Rouge River Realty, doesn't like flat-fee services that dump properties on to MLS, but he said consumers have a right to decide. "Just because I think it's a dumb business plan, why should I care?" he said. "Let [other realtors] do it."

Last month, the directors of the TREB voted to reject the CREA's proposed changes. In a letter to the association, TREB president Dorothy Mason said the proposals raise serious concerns and require more consultation. Directors of the Greater Montreal Real Estate Board have also asked to have the proposals withdrawn. However, many agents and real estate boards in Western Canada, where the market has been extremely strong, favour the proposed changes.

Bob Linney, a spokesman for the CREA, said the proposals are designed to protect the trademark. "It's entirely a trademark issue. It is not aimed at any one particular business model," he said. "Fees are always negotiable."

As for the Competition Bureau, Mr. Linney said the association has "an ongoing dialogue" with the bureau about a range of issues. It also has a legal opinion that says its proposed changes will not restrict competition.

Mr. Linney added that delegates will have the final say at the meeting in Halifax. "Nothing has been decided and we don't want to comment until it has been decided."

© The Globe and Mail

Snap Up Real Estate's Press Release Is Now Available At www.PR.com

Snap Up Real Estate's Press Release is now available at www.PR.com

Snap Up Real Estate recently launched a new real estate web site, and the Press Release has been published on PR.com. The release focuses on Snap Up Real Estate's entry into a tough real estate market, and emphasizes how and why the new company will succeed.

Snap Up Real Estate recently launched a new real estate web site, and the Press Release has been published on PR.com. The release focuses on Snap Up Real Estate's entry into a tough real estate market, and emphasizes how and why the new company will succeed.

Thursday, September 14, 2006

Snap Up Real Estate Is The Newest Online Real Estate Web Portal

Snap Up Real Estate is the Newest Online Real Estate Web Portal.

PRweb issued a release earlier this week concerning the launch on the new Canadian firm.

The full article can be viewed as a download or online.

Attached to the press release is a PodCast with the Operating Manager of Snap Up Real Estate, Bart Zirnhelt.

Friday, September 08, 2006

Lets Take A Look At What Is For Sale In Canada's Smaller Real Estate Markets

Lets take a look at what is for sale in Canada's smaller real estate markets.

In the Yukon $499,000 gets you this log home on the Mclintock River in Whitehorse.

In the Yukon $499,000 gets you this log home on the Mclintock River in Whitehorse.

This log masterpiece features 2 bedrooms, 2 bathrooms, 2400 sq/ft or living area, radiant heat flooring, guest cabin and huge 24x26 garage. Not too bad if you like the long winters.

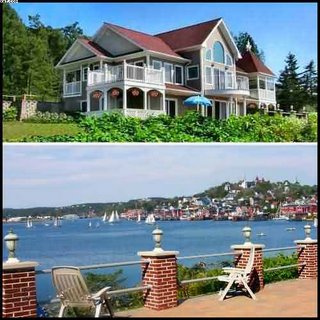

If Atlantic Canada is more your flavor perhaps this Home in Lunenburg, Nova Scotia will peak your interest.

You can check out the fantastic view from your 307 feet of ocean front, and enjoy your sail boat with the available deep mooring. All this goes for a cool $1.25 Million.

Finally lets take a look at what you can get for big money in Newfoundland and Labrador. For $1.375 Million you can get a 87 year old mansion in St. John's.

This home has 9 bedrooms, 9 1/2 bathrooms, 9 fireplaces, and 10 foot ceilings. A real piece of luxury on the Rock.

Friday, September 01, 2006

The United States Has Experienced A Downturn In It's Housing Market

The United States has experienced a downturn in it's housing market. Places like Florida have a vast number of condos for sale, but nobody left to buy them. Here in Canada the same problem should not occur. The following article shed to light on the housing question.

Vancouver, Calgary on realty slump watch

TD warns of 'flashing warning lights'

Housing markets in Western Canada are "flashing warning lights," and some cities might be on the cusp of a major price downturn, Toronto-Dominion Bank warns.

"There is no question that the recent dramatic price gains in Calgary and Vancouver are unsustainable, and that these urban centres are vulnerable to significant moderation, including the possibility of a pullback in prices at some point in the future," economists Craig Alexander and Steve Chan said in a note to clients yesterday.

The warning arrived just as the Canadian Real Estate Association reported that the number of home sales in Canada's major markets slipped 3.1 per cent in July from June.

Home sales through CREA's Multiple Listing Service in the first seven months of the year blew past all previous highs, and are on track to close the year with a new annual record. However, the association said a "marked increase in new listings in Alberta and the return to more normal levels of sales activity in British Columbia and Alberta" have left the national market "more balanced than it has been at any point in the past five years."

CREA's chief economist Gregory Klump said national sales are starting to come off record levels. "What is new this month is that there are signs that Vancouver and Calgary are starting to join that trend."

The TD economists acknowledge that housing activity in Western Canadian cities is easing a little, but say their real estate bubble-watch indicators suggest Calgary, Vancouver and Edmonton bear closer watching.

A series of weak U.S. data have generated worry that the slumping housing market south of the border will hobble U.S. economic growth. The concern is that Canada's real estate market will follow suit.

TD has consistently argued that Canada's real estate market has "generally lacked the degree of speculation that dominated past boom-bust cycles," and that excesses lag those evident in the United States.

The TD economists are sticking with that argument, but say they are concerned about certain pockets of the Canadian housing market.

The housing situation in Calgary, a city flush with oil money, has seen explosive growth in recent years, TD said. The city's housing situation has started to open up: Demand is easing, unit sales are weaker, new listings have picked up and the powerful sellers' market is showing signs of becoming more balanced.

"Given that the market is overheated at the moment, a bubble may be forming, or could easily develop, but the hope is that the trend toward a more balanced market continues," Mr. Alexander and Mr. Chan said.

The situation is similar in Edmonton, where robust demand and tight supply have fuelled a steep rise in prices. If the pace of price increases continues, a bubble could form, TD said. However, housing in Edmonton is still quite affordable, raising the chances of a soft landing.

In Vancouver, demand for housing is also softening, although that could be because the average resale home, at $509,606, is now the most expensive in Canada. Indications of weaker unit sales and rising listings suggest a soft landing, the TD economists said, but developments in the market need to be monitored.

The warning signs that TD sees in Western Canada are absent from the rest of the country.

"Other major Canadian real estate markets appear to be in much more balanced shape, and housing activity in Central and Atlantic Canada has already cooled without prompting a price correction -- supporting the view that a bubble never formed in these regions," the economists said.

Article by Roma Luciw of the Globe and Mail

Vancouver, Calgary on realty slump watch

TD warns of 'flashing warning lights'

Housing markets in Western Canada are "flashing warning lights," and some cities might be on the cusp of a major price downturn, Toronto-Dominion Bank warns.

"There is no question that the recent dramatic price gains in Calgary and Vancouver are unsustainable, and that these urban centres are vulnerable to significant moderation, including the possibility of a pullback in prices at some point in the future," economists Craig Alexander and Steve Chan said in a note to clients yesterday.

The warning arrived just as the Canadian Real Estate Association reported that the number of home sales in Canada's major markets slipped 3.1 per cent in July from June.

Home sales through CREA's Multiple Listing Service in the first seven months of the year blew past all previous highs, and are on track to close the year with a new annual record. However, the association said a "marked increase in new listings in Alberta and the return to more normal levels of sales activity in British Columbia and Alberta" have left the national market "more balanced than it has been at any point in the past five years."

CREA's chief economist Gregory Klump said national sales are starting to come off record levels. "What is new this month is that there are signs that Vancouver and Calgary are starting to join that trend."

The TD economists acknowledge that housing activity in Western Canadian cities is easing a little, but say their real estate bubble-watch indicators suggest Calgary, Vancouver and Edmonton bear closer watching.

A series of weak U.S. data have generated worry that the slumping housing market south of the border will hobble U.S. economic growth. The concern is that Canada's real estate market will follow suit.

TD has consistently argued that Canada's real estate market has "generally lacked the degree of speculation that dominated past boom-bust cycles," and that excesses lag those evident in the United States.

The TD economists are sticking with that argument, but say they are concerned about certain pockets of the Canadian housing market.

The housing situation in Calgary, a city flush with oil money, has seen explosive growth in recent years, TD said. The city's housing situation has started to open up: Demand is easing, unit sales are weaker, new listings have picked up and the powerful sellers' market is showing signs of becoming more balanced.

"Given that the market is overheated at the moment, a bubble may be forming, or could easily develop, but the hope is that the trend toward a more balanced market continues," Mr. Alexander and Mr. Chan said.

The situation is similar in Edmonton, where robust demand and tight supply have fuelled a steep rise in prices. If the pace of price increases continues, a bubble could form, TD said. However, housing in Edmonton is still quite affordable, raising the chances of a soft landing.

In Vancouver, demand for housing is also softening, although that could be because the average resale home, at $509,606, is now the most expensive in Canada. Indications of weaker unit sales and rising listings suggest a soft landing, the TD economists said, but developments in the market need to be monitored.

The warning signs that TD sees in Western Canada are absent from the rest of the country.

"Other major Canadian real estate markets appear to be in much more balanced shape, and housing activity in Central and Atlantic Canada has already cooled without prompting a price correction -- supporting the view that a bubble never formed in these regions," the economists said.

Article by Roma Luciw of the Globe and Mail

Subscribe to:

Posts (Atom)